A hostile takeover is an acquisition by an acquirer without the knowledge or consent of the target company's board of directors. The strong confrontation between the two sides is its basic feature. A hostile takeover is generally difficult to succeed unless the target company has a high stock float that can be easily absorbed in the market. Usually, some preparatory work will be done before a hostile takeover, which is mainly to establish an initial point in the market to initiate the takeover, that is, to buy the shares of the target company in the market until the shareholding of the target company reaches the requirements in the initial announcement. The advantage of this is that the purchase behavior is unknown and the purchase price is relatively low, which can reduce the acquisition cost. Another benefit is that the acquirer has become a shareholder in the target company before entering an open hostile takeover.

There are three common ways to implement a hostile takeover:

Open Market

The acquirer directly buys the stock of the target company in the open market until the shareholding in the target company reaches the level of the controlling shareholder. The realization of a hostile takeover through open market purchase requires the target company to have enough outstanding shares in the market and the target company's own equity is relatively dispersed as a premise.

Tender Offer

Tender offer refers to the acquisition method in which the acquirer issues to the shareholders of the acquired company a written statement of intent to purchase the company's shares held by them and acquires the shares of the target company in accordance with the acquisition conditions, acquisition price, acquisition period and other prescribed matters stipulated in the acquisition offer announced by the acquirer, in order to obtain the controlling interest of the listed company and obtain almost all the shares (at least 95% or more of the shares) of the acquired company.

Proxy Contests

Proxy contests refer to the fact that one or a group of shareholders obtain control of the company through the proxy mechanism of the company's voting rights. In China, this practice is also called a proxy buyout, in which the acquirer obtains the support of other shareholders of the company (such as mutual funds, pension funds) and minority shareholders. These funds and minority shareholders entrust their voting rights to the acquirer, so that the acquirer obtains relative or absolute control of the voting rights of the company, so as to strive for the approval of the acquisition.

How to Deal with A Hostile Takeover

A hostile takeover usually leads to an anti-takeover. Anti-takeover is aimed at resisting the acquisition behavior of the acquirer, maintaining the original interest pattern of the target company, and obstructing the realization of the acquisition purpose of the acquirer. Here are two ways a company can combat a hostile takeover:

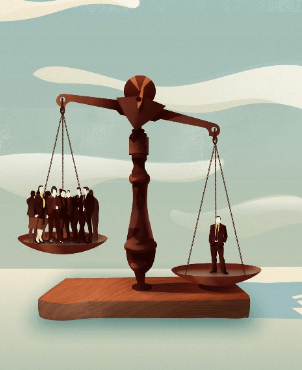

1. Weighted Voting Rights (WVR)

WVR means that within a company, at least two types of shares will be issued—common shares and privileged shares. Privileged shares have more voting power and are issued against a company's board of directors or management. WVR helps the company to raise funds through the secondary market, while the voting rights of the board of directors will not be too diluted, so that it is difficult for foreign acquirers to bypass the consent of the board of directors and carry out hostile acquisitions.

2. Poison Pill Program

The Poison Pill was invented in 1982 by Martin Lipton, a well-known American M&A lawyer. It is an anti-takeover measure that increases the cost of mergers and acquisitions, causing the target company to lose its attractiveness rapidly. When a company encounters a hostile takeover, especially when the acquirer's shares have reached 10% to 20%, the company will issue a large number of new shares at a low price or increase liabilities in order to maintain its controlling rights. Although the poison pill plan can prevent the acquisition to a large extent, it will also harm the vitality of the target company, worsen the business status, affect prospects of the company, and damage the interests of shareholders. Therefore, it is often opposed by shareholders.