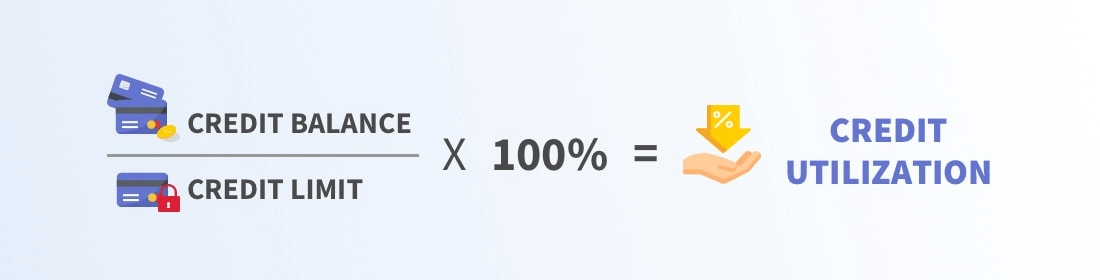

What is credit utilization?

Credit utilization is the percentage of balances and total available credit. It is also commonly known as balance to limit ratio.

The formula is simple: CU = credit card balance ÷ credit limit

Why is credit utilization so important?

CU accounts for up to 30% in many credit calculation formulas. For example, in common FICO, it limits the amount of Amount to Debt to 30%. From the perspective of banks or credit issuers, the CU ratio can reflect whether users can reasonably arrange their income and expenditure, and whether they can pay off all balances on time. The less risk a user presents, the more likely the bank will give a higher credit limit or the easier it will be to approve a credit application.

What is a good credit utilization ratio?

If you need to increase your credit scores quickly, it is more appropriate to control the CU below 30%. Lowering your credit card balance is usually an effective way to improve your credit scores. Controlling consumption below 30% of the credit limit will make it more likely to pay off the arrears on time.

Why does cancelling your credit card affect credit scores?

When we cancel the credit card, the overall credit limit will drop. If your consumption habits do not change much, it will undoubtedly push up the ratio of credit utilization, which will affect the credit score.

In addition, an important indicator for judging credit scores is time. If a credit card that has been opened for many years is closed, it will undoubtedly reduce the average credit time, which will seriously affect the credit score. Therefore, I recommend that cards without an annual fee can be set aside if they are not needed. Cards with an annual fee can be downgraded. Do not close a credit card casually.

In conclusion, in order to get a better credit score, we should pay attention to our consumption habits, control credit consumption within a reasonable range, and repay on time. For those who have to change the credit card, it is recommended to apply for a new card first, and then close the old card, because the closing will damage the credit score as well.

Different credit limit of different banks

The credit limit represents the payment ability of your card, which is a consideration of your overall credit by the bank. If the quota is too low, it will be embarrassing for you to buy very expensive goods; if the quota is too high, there will also be certain drawbacks. Today, I will share with you the rules of each bank regarding credit card limits.

What is the credit limit?

The credit limit is generally a maximum overdraft amount given by the bank. Generally speaking, the total amount of debt on a credit card cannot exceed the credit limit.

Credit limit is divided into total limit (credit limit) and available credit. The total amount is relatively fixed and does not change with your consumption. But the available credit is related to your current card usage.

What determines the initial credit limit?

When you apply for a credit card and are approved, you can usually check the limit of your credit card via phone. The initial credit card limit is related to your current credit score and credit report. Generally, the higher your credit score, the fewer negatives on your credit report, and the higher your income, the higher your credit limit.

What is the difference in the amount given by different banks?

Regardless of credit history and credit score, when the same person applies for a credit card at different banks at the same time, the obtained amount is also different.

• American Express: It is the most generous company in terms of the initial amount. Usually, when you apply for the first card, you can get a credit limit of more than 2,000 US dollars.

• Citi: The quota is also good, and it gives people with a credit history of about one year more than 1,000 US dollars.

• Chase: It is a very stingy company in the beginning. Your credit limit of your first card may only be $500-$1000, but after you hold the credit card for a while, the limit will be increased greatly.

• Discover: People with no credit history are generally given a quota of $500-$1000, and the initial quota is not high, but it is very suitable for green hands.

• US Bank: The credit limit is okay. When you have credit history of one year, it will give you a quota of $2000-$5000. It is not recommended for green hands to use this card.

• Bank of America: The quota is relatively stingy, only about $1000, but it is more suitable for people with short credit history to get started.